Suppose you go to the mall and purchase a widescreen monitor for a $1,000 paying for it with your newly minted Visa credit card. Unfortunately upon installation, you find it is defective and is not worth the fuel cost to return it to the merchant. Who pays the credit card balance? Will the U.S. taxpayer pick up the tab? NO! The cost will be borne by either the merchant, wholesaler, manufacturer, or you.

That is essentially what has happened to many college graduates who borrowed thousands to earn a college degree that, in many cases, entitled them to nothing more than a job selling jockey shorts at Montgomery Ward (I go back a long way).

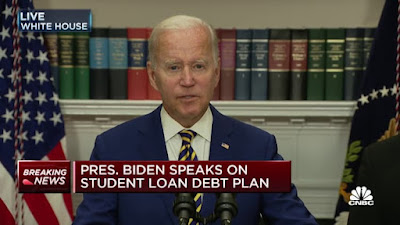

Month-after-month, President Biden has delayed loan repayments for college tuition incurred at colleges ranging from the bottom to the top of the nation’s post-secondary institutions. Now he has proposed forgiving loans up to $20,000 for those making less than $125,000, and once again postponed payments for the rest. Estimates of the taxpayer cost of these actions have ranged from $300-$500 billion depending on the assumptions of the estimation model.

Why are the real beneficiaries, the colleges, sitting on the sidelines cheering on this costly proposal? A study by the New York Federal Reserve (https://tinyurl.com/4da9mc8b) concluded that 60 cents of every federal loan dollar simply landed in the coffers of colleges in the form of higher tuition revenue. As a result of this linkage, colleges have raised tuition five times the rate of inflation since 1980. At the same time college endowments soared to roughly $691 billion in 2022.

I propose that the cost of the student loan program be shared by the taxpayer, the university, and the student. The program will work very similar to unemployment pay systems in most states. Each semester, colleges will pay an experienced based fee that rises and falls with the past students’ repayment, or experience rating. Just as construction firms in Nebraska, due to higher historic layoff rates, pay more than four times the unemployment tax rate of non-construction firms, colleges with a history of student loan defaults and delinquencies will pay higher fees into the fund. This program will thus shift a portion of the cost of student loan defaults to those that helped create it---the colleges.

Transferring a portion of the cost of student loan defaults and delinquencies to the colleges will cause the institutions to 1) improve their educational processes to boost potential financial success in the labor market post-graduation, 2) improve the student selection process by including future economic viability of graduating students, 3) charge lower or higher tuition, depending on the salary outlook of particular majors, 4) insure that students receive true value or marketable skills from their studies. In the end, this program will slow the growth in tuition for all (even non-borrowers), and reduce taxpayer costs.

Ernie Goss

No comments:

Post a Comment