The IRS just performed its yearly financial appendectomy on the U.S. taxpayer. But apparently this year’s removal was not large enough for the Biden Administration. For fiscal year 2023, in terms of tax burdens, Biden has proposed making the U.S. number one among developed nations with $2.5 trillion in new taxes. Not to worry, he has guaranteed that these taxes will fall on what he terms as the “rich,” or workers and entrepreneurs who have achieved higher income via education, bright ideas, or just plain hard work.

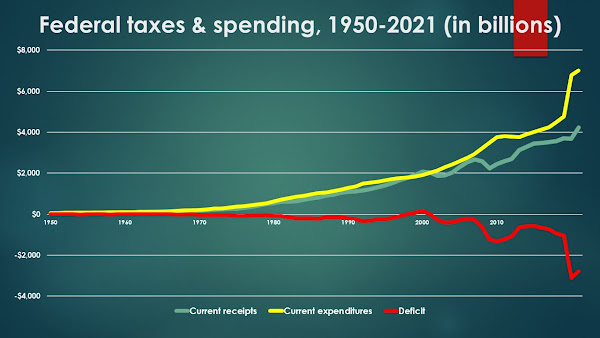

For the current fiscal year, the federal government will spend $6.011 trillion, or 26.1% of the total U.S. economy. Since the beginning of the pandemic, federal spending has soared by 47.5%, while the economy has inched up by only 7.6%. Biden’s proposed budget will push spending as a share of the economy to its highest level since economists began the process of national accounting.

To pay for this indulgence, Biden will the raise the tax on each additional $1,000 of income that high income individuals earn from $429 to $573. On top of this increase, the administration proposes a complex tax on the unrealized capital gains of high-net worth individuals including hard entrepreneurial founders. Under this plan, high income taxpayers with a gain in company stock values, or in the entrepreneur’s net worth would pay taxes on the gain even though the stock, or company, has not been sold. Mr. Biden would also raise the combined state and local corporate income tax rate from 25.8% to 32.3% and well beyond the 22.8% average for the 37 nations of the OEDC.

Not only will these actions punish entrepreneurs and investors financially, it will create bookkeeping nightmares for taxpayers while enlarging the IRS bureaucracy to handle the new tax law.

Biden’s Budget Blooper (BBB): more leisure, less work; more bureaucracy, less entrepreneurship.

Ernie Goss

No comments:

Post a Comment